aurora co sales tax rate

Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling. The December 2020 total.

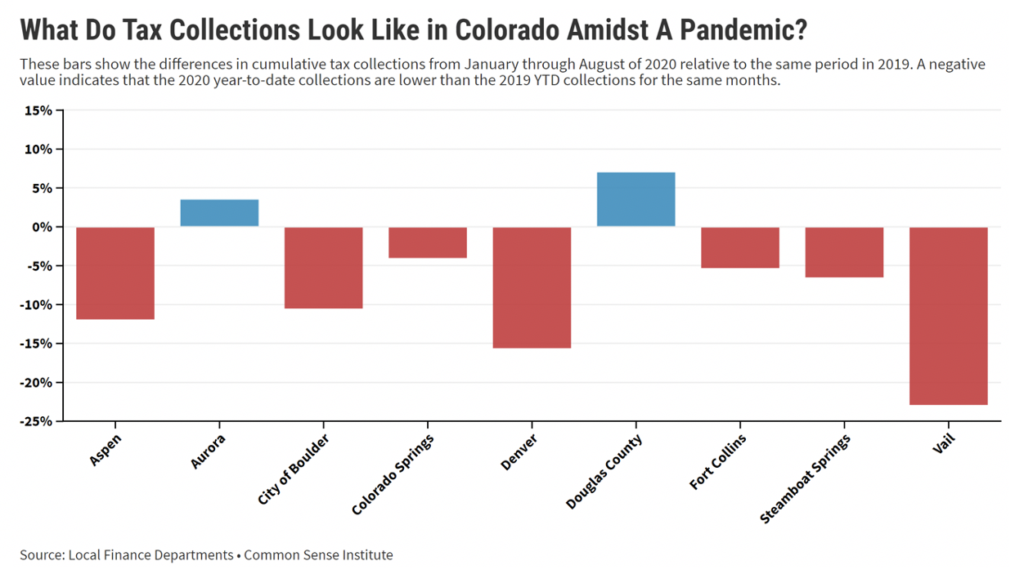

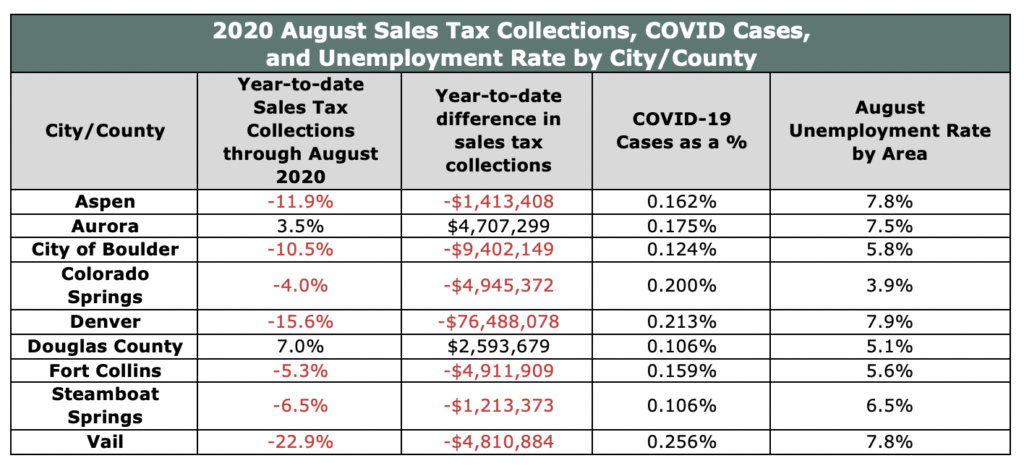

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

This is the total of state county and city sales tax rates.

. The December 2020 total local sales tax rate was also 0000. Boulder CO Sales Tax Rate. 4 rows The current total local sales tax rate in Aurora CO is 8000.

The current total local sales tax rate in Aurora SD is 5500. The current total local sales tax rate in Aurora OH is 7000. The current total local sales tax rate in Aurora MO is 8850.

Aurora Sales Tax Rates for 2022. The current total local sales tax rate in Aurora NE is 5500. The minimum combined 2022 sales tax rate for Aurora Colorado is.

The current total local sales tax rate in Aurora OR is 0000. 6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora.

The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025. Brighton CO Sales Tax Rate. Special Event Tax Return.

The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. The Colorado sales tax rate is currently. The December 2020 total local sales tax rate was also 5500.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Because Angie is a dealer in office chairs they buy them free of Aurora. Angie Office Furniture has an executive chair in inventory.

The December 2020 total local sales tax rate was also 5500. The President of Angie needs a new chair for her office. This sales tax will be remitted as part of your regular city of Aurora sales and use tax.

Arvada CO Sales Tax Rate. There is no Aurora income tax imposed on nonresidents who work in Aurora although they may have to pay the resident local income tax in their own municipality. The December 2020 total local sales tax rate was 7250.

The Aurora Colorado sales tax rate of 85 applies to the following twelve zip codes. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax. Aurora CO Sales Tax Rate.

Aurora NE Sales Tax Rate. 6 rows Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month.

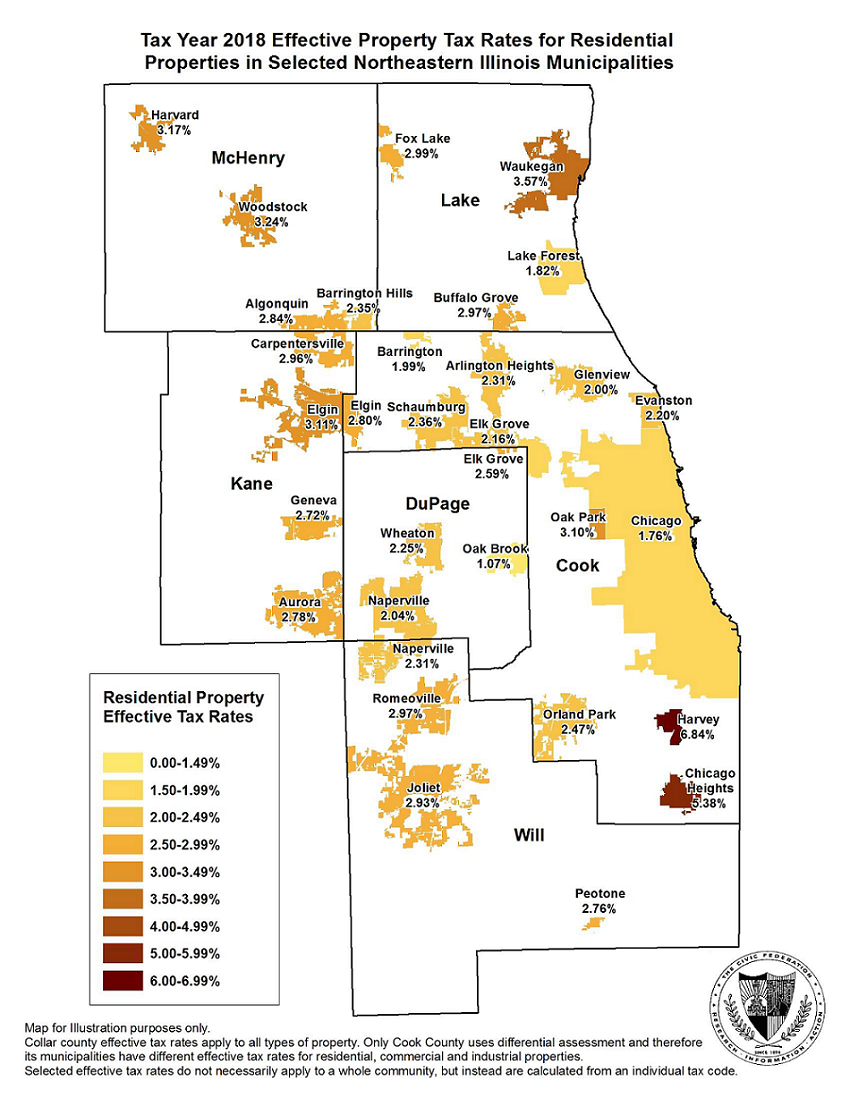

Estimated Effective Property Tax Rates 2009 2018 Selected Municipalities In Northeastern Illinois The Civic Federation

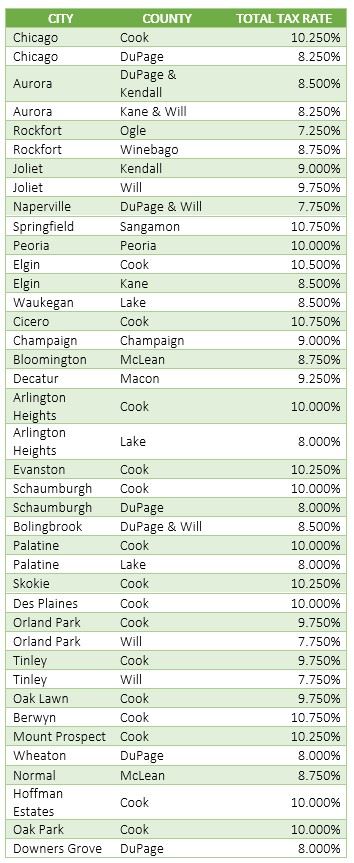

Illinois Sales Tax Guide For Businesses

Fees Sales Tax City And County Of Denver

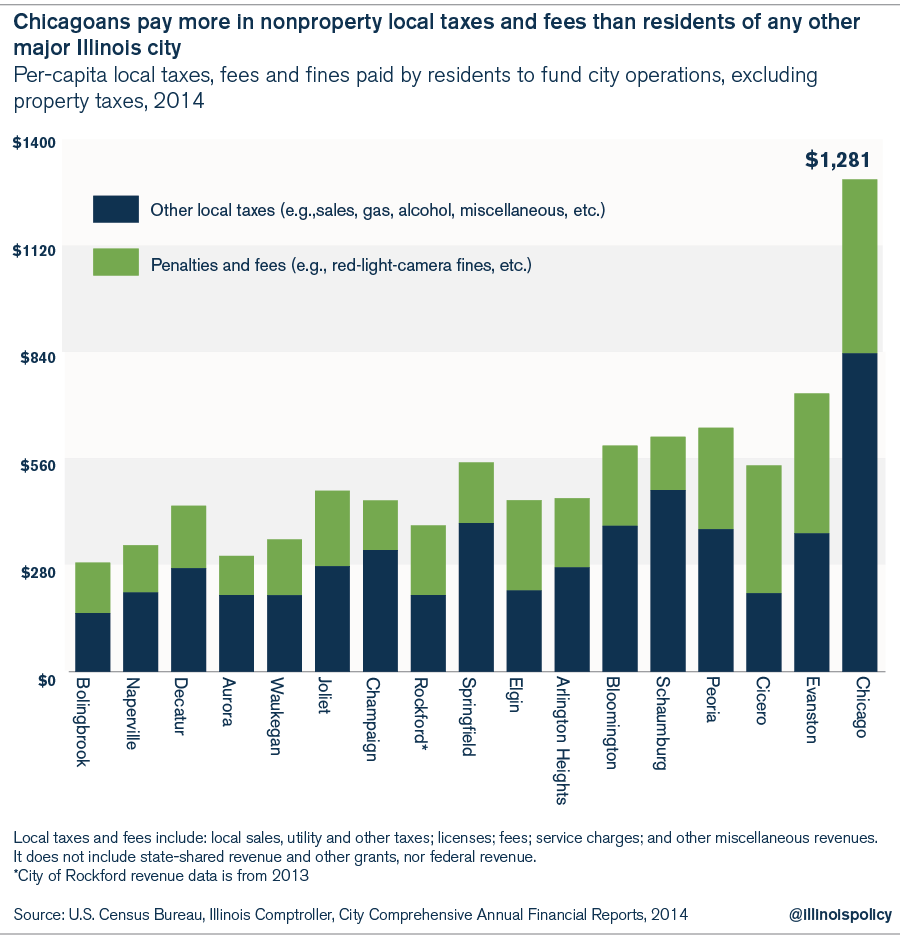

Chicagoans The Most Taxed Residents In Illinois Paying More Than 30 City Taxes

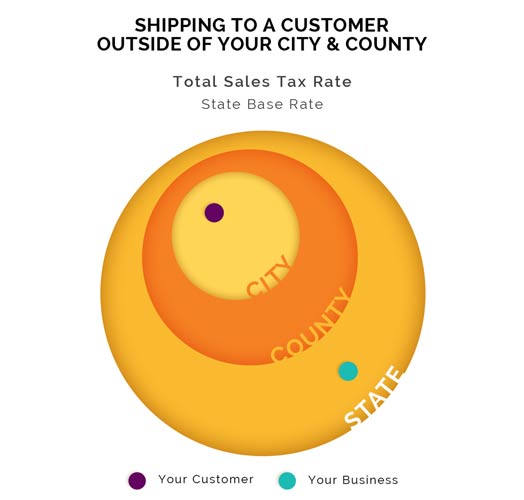

Colorado Sales Tax Small Business Guide Truic

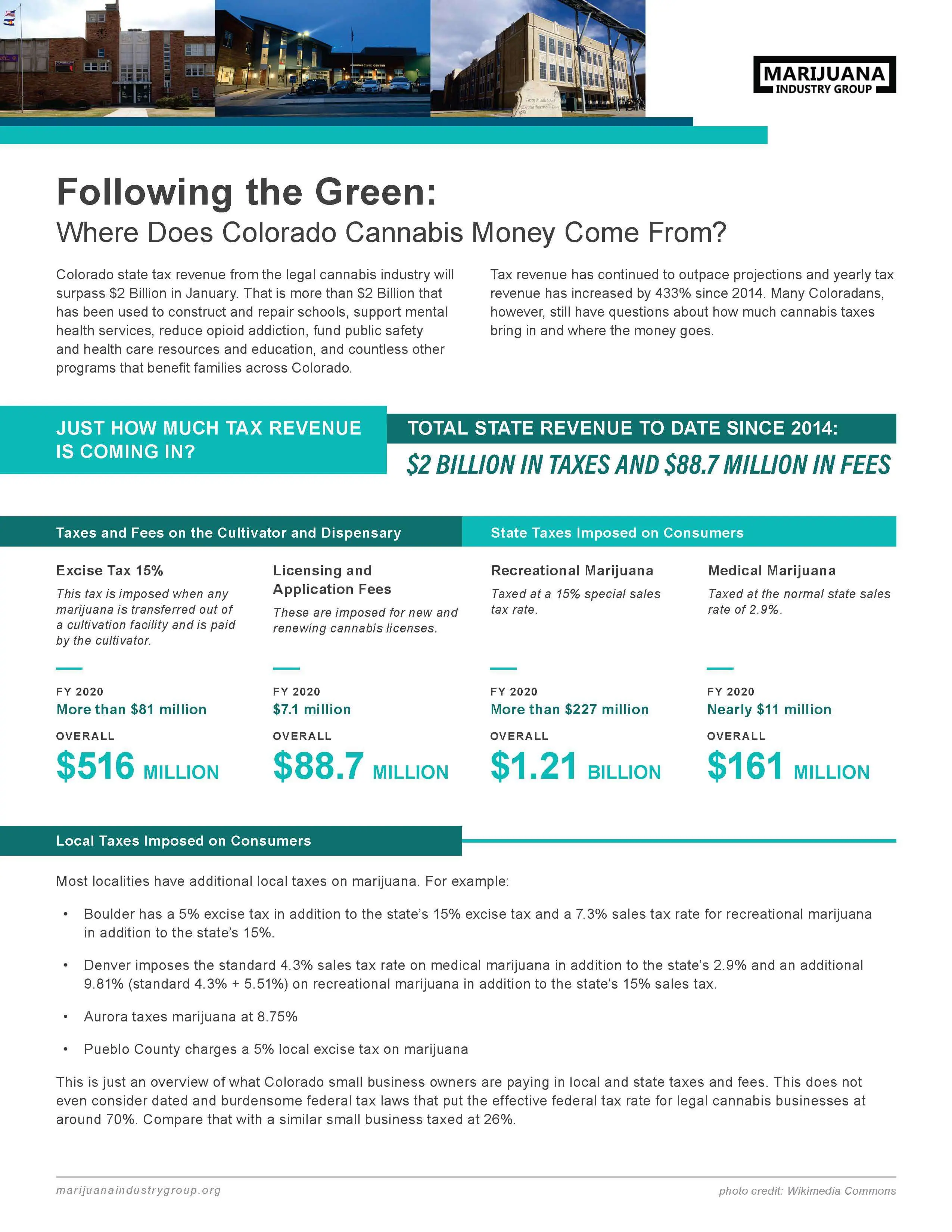

Where Does The Colorado Cannabis Tax Money Go Marijuana Industry Group

Property Taxes By State Quicken Loans

Centennial Encompass Business Park

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

What Is Subject To Sales Tax What Is Excluded In Washington State Asp

Simplify Colorado Tax Simplify Tax

Colorado Sales Tax Rate Rates Calculator Avalara

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

These Denver Neighborhoods Are Getting The Biggest Property Tax Hikes Denverite The Denver Site